As I sit down to write a check to cover son number three’s auto insurance payment, I realize my bank account is taking another hit. It’s not the first time, and I’m not the only one. Parents like us have quasi-adult children on economic life support.

When we blended our families, my husband and I never intended to become the “Bank of Dad & Mom.” When Steve and I combined our seven sons into one family in 2001, the economy was strong. I thought it’d be a breeze to put my two oldest to work when we packed up our home in Chicago and moved south to Atlanta. Just a few short months later, our country and the economy reeled from the 9/11 attacks.

It took much, much longer than expected to get the first two of our seven out of the house and on to independence. But, it looked totally doable. Both of them invested in lower-priced homes, one in 2004, the other in 2005. With jobs it looked like a wise use of their money. But, then the Great Recession of 2007 roared to life. Son number one tried to go back to work after Christmas holidays and found the doors to his company padlocked because of a corporate bankruptcy. Son number two was a remodeler. Funds for remodeling soon evaporated. But, both sons still had mortgages.

As we’ve struggled to help our seven boys become independent, we’ve discovered disaster can come in an instant. Son number three at age 23, was working part-time in a video store (the only job he could find) when he came up with a “pimple” on his jaw. It soon morphed into a medical emergency that escalated to admission to the local hospital. He’d contracted a severe case of MRSA (drug-resistant Staph) that was headed towards his heart. Before the week was out, he had $60,000 in medical bills with no health insurance.

Son number four decided to move to Hollywood, Calif. to live with a friend. It was a good decision in 2008. He had skills as a mechanic and $25,000 in the bank. In quick order he found a job and then lost it because of the economic slowdown. Before he knew it, his bank account had trickled down the drain. We always have to make crucial support decisions such as: “Do we still pay for a cell phone so that he can get a job or do we cut him off making him more dependent?”

These questions are never easy. We get one boy going a couple of steps in a good direction, and then disaster strikes another. Thankfully, we’ve taught all of our sons to hate debt. They’ve paid cash for everything in their lives, much like we do, while learning the cachet of living frugally.

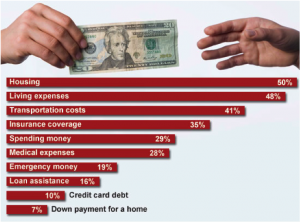

Like I said, my husband and I aren’t alone in this struggle, according to the National Endowment for Financial Education and Forbes-Woman. Questioning 1,074 parents, they discovered that 59 percent provide some form of financial assistance to adult children (over the age of 18) who are not enrolled in school

The Miller Family

It seems to me that a fundamental shift has occurred in our economy from my generation to my sons’ generation. When I was 18 and graduated from high school, I took a job in a bank, found my first apartment with a roommate and paid a whopping rent of $65 per month. My job, lack of a car, and frugal lifestyle allowed me to save up enough money to buy my first house at age 21. Granted, I lived in Madison, Wisconsin, a lower-priced market and I only paid $22,000 for that 900 square foot beauty, but it was possible for me to live and take care of myself on my salary.

Will my husband and I ever feel “safe” from financial ruin? Probably not. Yet, we’re not the only ones. Until he can find a job, my sister is “supporting” her 30-year-old who just separated from the Navy and my carpool partner has a 24-year-old living with her, a refugee from Michigan’s economy. As parents we are not alone, but I’m wondering who’s going to pick up the financial slack when my generation is gone? Even with all of the financial support we’re providing our quasi-adult kids, I’m e-x-t-r-e-m-e-l-y thankful that all seven of them haven’t decided to cash it in and move back home.

Cherie K. Miller lives on a lake in Georgia with her husband, Steve, and a blended family of seven sons, two dogs, two leopard geckos and one freakishly grumpy 17-year-old cat. Steve & Cherie have a nonprofit organization that provides compelling character development curriculum for use in by parents, in schools, or other community organizations. Reach me at www.character-education.info