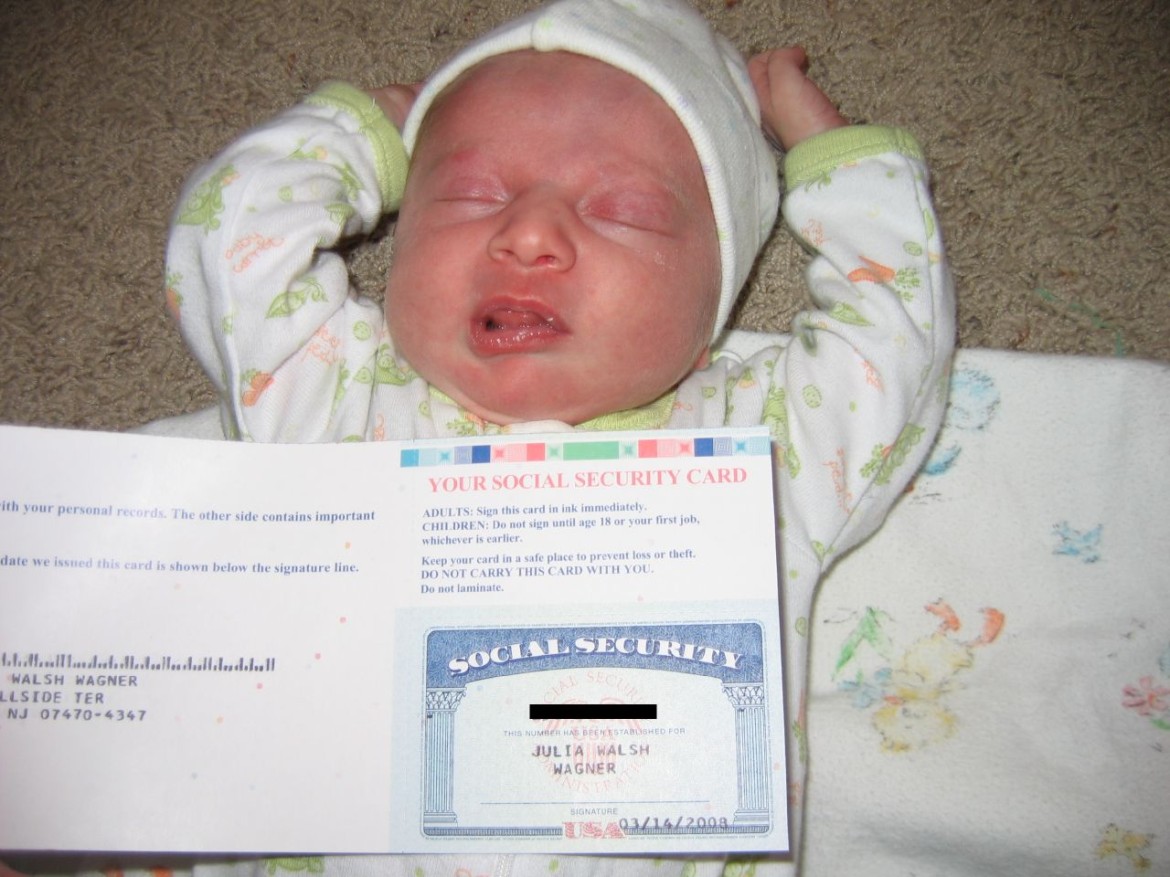

Children, even toddlers and infants, are at risk of identity theft.

Children, even toddlers and infants, are at risk of identity theft.

In fact, kids under the age of 18 are 51 times more likely to become victims of identity theft than their parents, according to a recent report by Carnegie Mellon CyLab.

Out of a representative sample of more than 40,000 juveniles, 10.2 percent, or 4,311 kids, fell prey to some sort of identity theft or fraud, compared to just 0.2 percent of adults in 2009 and 2010.

According to CyLab, the main reason minors' identities are so valuable -- specifically their Social Security numbers -- is that there’s no process in place to double check what name and birth date are officially attached to each number. Thus, “as long as the identity thief has a Social Security number with a clean history, the thief can attach any name and date of birth to it.”

Minors also make a tempting target because the theft may go undetected for years, according to the credit-reporting agency TransUnion. It takes little more than a Social Security number to open most bank and credit accounts.

While children under five are susceptible to identity theft the group accounts for just 7 percent of the minors in the CyLab study. Teens aged 15-18 fell victim to theft more frequently than any age group , accounting for 43 percent of the total sample.

The stolen Social Security numbers are typically used to bypass illegal immigration constraints (to obtain false identification for employment, for example), commit financial fraud and work around bad credit ratings, according to the study.

Seventy percent of cases CyLab examined involved financial fraud in the form of loan and credit accounts. Utility fraud ranked second most common at 18 percent.

Identity theft can have lasting repercussions, especially if unchecked for an extended period of time. Many youth may not discover the fraud until being denied student loans, jobs or living space after high school due to a checkered financial history.

Couple the lack of safeguards within the Social Security system with an increasingly tech-saturated youth culture and the potential for fraud is even greater. Dangers online can range from an inappropriate private message from a stranger on Facebook to sophisticated phishing programs aimed at extracting a child’s identity.

More than two thirds of children 2-5 years old could operate a computer mouse, while just 17 percent could tie their own shoelaces, according to a January Biz Report article. This trend, representing a more tech-savvy youth at a younger age, adds pressures on many parents to have “the money talk” and “the social media talk” as early as possible.

In 2010, more than 1.2 million complaints of fraud and identity theft were reported to the U.S. Federal Trade Commission. While no national statistics are kept on those younger than 18, Florida’s Attorney General’s office estimated that more than 500,000 minors nationwide were affected each year.

Identity Theft 911, a company specializing in data risk management, resolution and education, recommends taking these five steps to protect the identity of children:

1. Don’t carry around a child’s Social Security card. This increases the risk of losing the card, which is the most common way identity thieves obtain a child’s information.

2. Be discriminating when asked for a child’s personal information. If it has to be provided, ask how it will be stored. If the information will not be retained, inquire how any record of it will be destroyed or returned.

3. Shred documents with personal identifying information before disposing of them.

4. Don’t post children’s pictures online. Most digital cameras have geocoding features that embed within images the location where pictures were taken. This gives identity thieves information they can use to steal children’s identities.

5. Don’t give children their Social Security numbers until they understand how and why to protect the numbers.

Photo credit: Kurt Wagner/Flickr

Pingback: Identity Guard Review – top10

my daugther anna andi her nadine kowalchin her have know yheft in are house or at home