Student advocates worry that a pending interest rate increase on federally-administered student loans will further burden borrowers, potentially adding thousands of dollars to the cost of financing a college degree. Student loan interest rates are set to increase from the current rate of 3.4 percent to 6.8 percent for loans made after June 30.

Student advocates worry that a pending interest rate increase on federally-administered student loans will further burden borrowers, potentially adding thousands of dollars to the cost of financing a college degree. Student loan interest rates are set to increase from the current rate of 3.4 percent to 6.8 percent for loans made after June 30.

Rates have been at an artificially low 3.4 percent since Congress pasted the College Cost Reduction and Access Act of 2007, a plan to improve educational access by incrementally reducing rates over a four-year period. The rates will jump back to 6.8 percent July 1 if Congress fails to extend the bill, the New York Times reported.

Students rallied at the nation’s Capitol last week to protest the increase in subsidized loans, generally made to low- and medium- income undergraduate students through the federal Stafford program, the Associated Press reported.

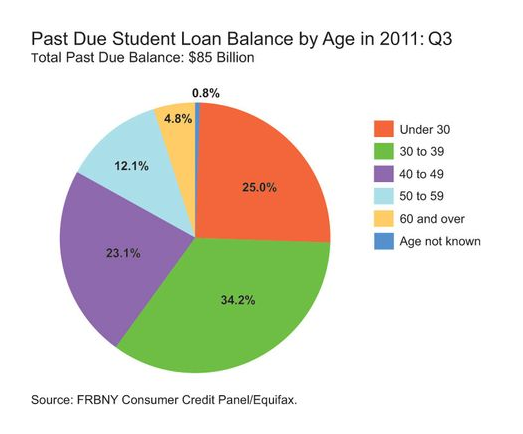

To add to concerns, a recent study released by the Federal Reserve Bank of New York showed 27 percent of the 37 million student loan borrowers in the United States had past-due balances of 30 days or more. Of borrowers under the age of 30, roughly 40 percent had outstanding loans, with an average debt of slightly more than $23,000.

Mark Kantrowitz, publisher of FInaid.org, told New York Times in an e-mail that the rate increase was actually “the lesser of two evils,” citing cuts to the federal Pell Grant program. The government actually looses money offering interest rates of 3.4 percent, he said.

Even if the interest rate is increased, it’s unclear whether or not additional funding would be made available for the Pell Grant program.