Senate Bill to Extend Current Student Loan Interest Rates Defeated

|

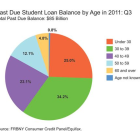

Tuesday, Republicans in the U.S. Senate blocked a bill backed by Democrats that would have kept interest rates for certain federal student loans from doubling this July. By a 52-45 majority, GOP senators effectively killed the proposal – entitled the Stop the Student Loan Interest Rate Hike Act of 2012, it marking this Congress’ 21st successful filibuster of a Democratic-sponsored bill, according to The New York Times. If an extension of current federally-subsidized student loan rates does not occur, loan rates for undergraduate students are expected to jump from 3.4 percent to 6.8 later this summer. According to recent reports, American students took out almost twice the value of student loans in 2011 - estimated at about $112 billion – than they did a decade ago. In 2010, student loan debt totaled approximately $1 trillion, eclipsing credit card debt as the nation’s second largest form of debt behind mortgages, USA Today reported.